Advanced Financial

structures for global investors

Renowned Investors

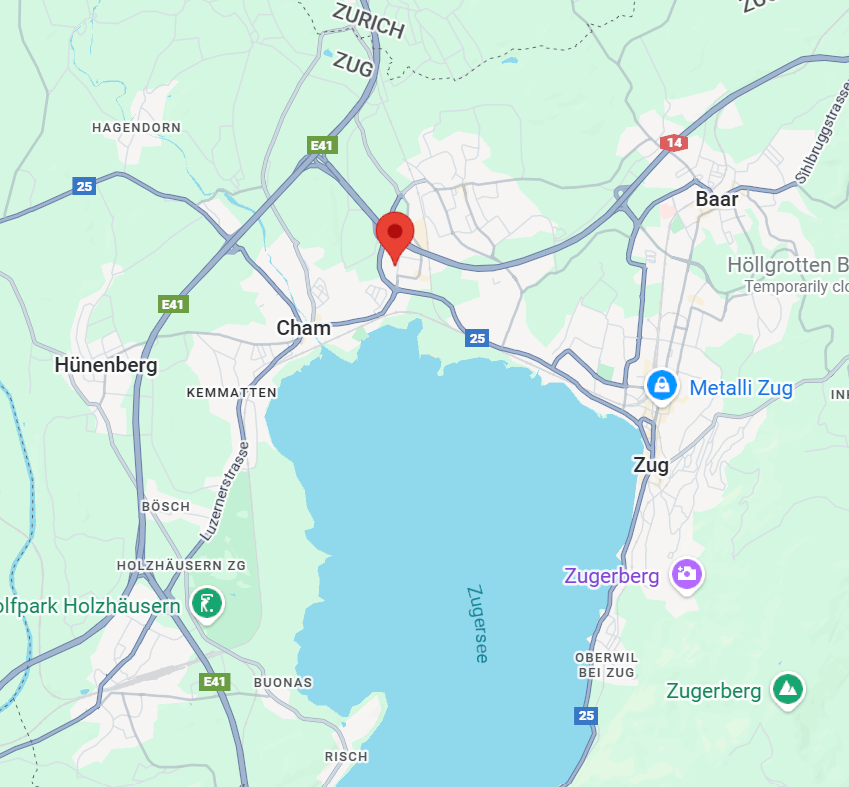

At Belmonte Capital, we design and implement advanced financial structures using Luxembourg’s premier investment and holding vehicles. With offices in Luxembourg and Switzerland, we work with a team of experienced legal professionals and regulatory specialists to create compliant, tax-efficient structures tailored to international entrepreneurs, family offices, and investment firms.

Taking care of everything

We manage the entire setup process from start to finish: From the legal incorporation of entities, KYC and regulatory filings, to introducing clients directly to reputable fiduciary providers, accountants, and notaries.

Services

Family Office Structuring (SPF)

Provides customized investment strategies tailored to help users achieve their retirement.

Securitisation Vehicles (SV/SPV)

Monitors the performance of users’ portfolios and automatically adjust asset allocations.

Alternative Investment Funds (AIF)

Allows users to visualize their projected income streams to make informed decisions.

Why Belmonte?

Out-of-Scope Structuring

We advise on how to structure your fund and manage your

company to operate efficiently.

Full Licensing Assistance

We offer support during the full licensing process with the CSSF.

Regulatory Compliance

We provide expert advice on the implementation of financial laws and regulations